Hedge fund owners with a ton of industry experience vs. a bunch of Redditors is a wild match-up.

Credits: Wikimedia Commons/Tdorante10

Credits: Wikimedia Commons/Tdorante10

GameStop is a place that holds a lot of fond memories for people who had the fortune of having an outlet in their area. We were lucky enough to sit down and have a chat with the company’s Co-Founder, Gary Kusin, to understand more about its history, his opinion on relevant gaming industry issues, and more.

AD

Having been in the industry for several decades, Kusin had a lot of interesting information to share; one piece being an interesting comparison between GameStop’s fans and Swifties, which makes a lot of sense when you think about it.

GameStop Co-founder Says Its Fans Are as Loyal as Swifties

GameStop’s co-founder has a lot to say about the short squeeze saga

GameStop’s co-founder has a lot to say about the short squeeze saga

During our comprehensive interview with Kusin, we asked him what he thought about the company’s infamous stock short squeeze, given that it happened after he resigned.

He explained that he and co-founder James McCurry decided not to say anything to the press, despite knowing what was happening:

GameStop was the first company to develop such a deep relationship with its customers that has withstood the test of time.

He explains that the store had become an integral part of many gamers who were in their 30s and 40s. Midnight releases where tons of gamers would line up outside the store waiting to be let in and purchase a copy of the latest release is an iconic sight:

The only thing that comes close to GameStop’s relationship with its customers is Taylor Swift and the Swifties.

Anything said against Swift would draw the wrath of her fans. And, that’s what happened to the hedge funds.

AD

COVID-19 hit hard, and digital purchases were quickly outpacing physical ones. The brand was gradually inching toward obsoletion, and hedge funds lost faith in the company. However, their algorithms failed to factor in the company’s and its customers’ relationship. He adds:

When you then factor in a huge communication tool like Reddit, which was able to unify all of the birds of different feathers, it became unstoppable.

He calls hedge fund owners “analytical” and says that Wall Street operates in a “cold” way, because of which they never accounted for the emotional factor, and their plan backfired.

How r/WallStreetBets Saved a Company

Redditors pulled off an insane move to save a piece of their childhood nostalgia

Redditors pulled off an insane move to save a piece of their childhood nostalgia

Back in January 2021, r/wallstreetbets users noticed that many big hedge funds were betting against GameStop’s stock.

AD

They bought tons of stocks to mess with the hedge funds, which drove the price through the roof. At one point, the stock was worth over $500 per share, higher than anyone expected.

Some online brokerages, like Robinhood, suddenly stopped people from buying more shares. The brokerage was accused of market manipulation, with many class action lawsuits filed against it.

The gaming retailer’s stock price stayed high until it announced it would sell more stock, and the price dropped by a third. Everyone thought it was game over, but the stock shot up again by more than half.

AD

What do you think of the whole stock short squeeze ordeal? Let us know in the comments below!

News

BREAKING : Whoopi Goldberg’s The View drops 65% in viewership amid Roseanne wins new show.P6

As Roseanne’s Morning Show Triumphs, ‘The View’ Faces a 65% Ratings Plunge: Navigating the Crossroads of Morning Television In the ever-evolving landscape of morning television, the once-unassailable…

Charlie Puth honors his close friend Taylor Swift for inspiring and motivating him to release creative new songs.P6

Charlie Puth credits pal Taylor Swift for inspiring him to release new music. On Tuesday, Puth, 32, took to Instagram to announce his song, “HERO,” releasing Friday, and his upcoming album. He…

Breaking News: Harrison Butker Will Be the First NFL Player on Roseanne’s New Show.P6

In an intriguing blend of sports and entertainment, Harrison Butker, the well-known Kansas City Chiefs kicker, is set to become the first NFL player to appear on…

Garth Brooks and the Dixie Chicks collaborate to produce a new country music album called “We’re True Country” – The impressive return of two legends!P6

In a thrilling revelation for country music fans, Garth Brooks and The Chicks (formerly known as the Dixie Chicks) have unveiled plans to release a new album…

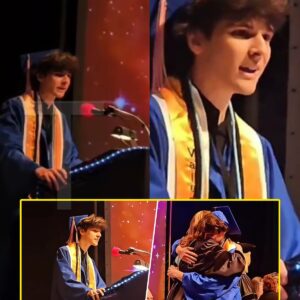

A Texas high school graduate is making his father proud and giving a speech that touched many.P6

“I can’t throw something away that he worked so hard for me to achieve,” Alem Hadzic said during his graduation speech Published on May 22, 2024 01:12PM…

Christie Brinkley, Age Is Just a Number: Youthfulness Makes It Hard to Distinguish Between Her and Her Daughter Like Two Drops of Water.

Sailor harmonized with her mother, flaunting her tiny body in a skintight hot pink dress and accessorizing with a white purse. Peter Cook and Christie Brinkley were…

End of content

No more pages to load